GetEViewsApp ( instance = 'new', showwindow = True ) > evp. > import pyeviews as evp > eviewsapp = evp. Then call the PutPythonAsWF function to create pages for the benchmark and indicator series: Set showwindow (which displays the EViews window) to True.

#Eviews vs r series

Series (, index = dtsq, name = 'indicator' ) date_range ( '1998q1', periods = 12, freq = 'Q' ) > indicator = pa. Series (, index = dtsa, name = 'benchmark' ) > dtsq = pa. date_range ( '1998', periods = 3, freq = 'A' ) > benchmark = pa. > import numpy as np > import pandas as pa > dtsa = pa. We’ll call the annual series “benchmark” and the quarterly series “indicator”:

#Eviews vs r download

Or, download the package, navigate to your installation directory, and use: $ python setup.py installįor more details on installation, see our whitepaper.

#Eviews vs r windows

For example, head over to the pyeviews package at the Python Package Index and at a Windows command prompt:

#Eviews vs r install

It has the ability to use a higher-frequency series as a pattern for the interpolated series to follow. Chow-Lin interpolation is a regression-based technique to transform low-frequency data (in our example, annual) into higher-frequency data (in our example, quarterly). We’re going to use the popular Chow-Lin interpolation routine in EViews using data created in Python. Here’s a simple example going from Python to EViews. (For more information on COM and EViews, take a look at our whitepaper on the subject.) This package uses COM to transfer data between Python and EViews. I really appreciate it if you can solve my problem.The purpose of the pyeviews package is to make it easier for EViews and Python to talk to each other, so Python programmers can use the econometric engine of EViews directly from Python. I checked the vignette of rugarch package for many times and cannot find any mistakes in the syntax, and R didn't show any error as well.

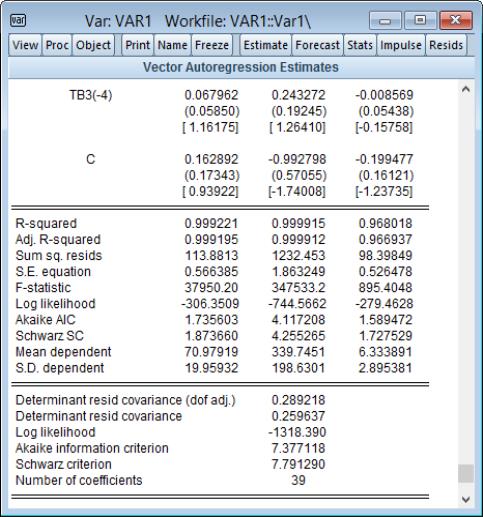

Other estimates have some differences with their counterparts, but they are all minor. List(stationarity = 1, = 0, scale = 0, rec.init = 0.7))Īs you can see, the dummy variable (denoted by vxreg1) is totally insignificant using rugarch in R contrary to a 2.58% p-value in the EViews result. Start.pars = list(), fixed.pars = list())įit<-ugarchfit(spec=garchspec, data=xts, out.sample = 0,solver="solnp", Mean.model = list(armaOrder = c(0, 0), an = TRUE,Īrchm = TRUE, archpow = 1, arfima = FALSE,Įxternal.regressors = NULL, archex = FALSE), Submodel = NULL, external.regressors = T, Garchspec<- ugarchspec(variance.model = list(model = "sGARCH", garchOrder = c(1, 1), Re=read.table("return.csv",sep=",",header=TRUE) Where T is a dummy variable containing 0 and 1 to indicate structural change. $$ \sigma^2_t = \omega + \alpha \varepsilon_ + T$$

Here are its mean and variance equations. I'm dealing with a GARCH-M model that I've estimated using R and EViews.

0 kommentar(er)

0 kommentar(er)